Bad news is not good news according to Wall Street

What Happened Last Week: Investor Focusing on the State of the Economy, Not on the Fed’s Next Move? An Analysis Using the CNN Business Before the Bell Newsletter

A version of this story first appeared in CNN Business’ Before the Bell newsletter. Not a subscriber? You can sign up right here. The same link will allow you to listen to the audio version of the newsletter.

The central bank said at its meeting in March that it would delay raising rates until this year, just a few days after bank failures heightened concerns about the economy. With interest rate hikes done, investors are concentrating on how the economy is doing and not on the Fed’s next move.

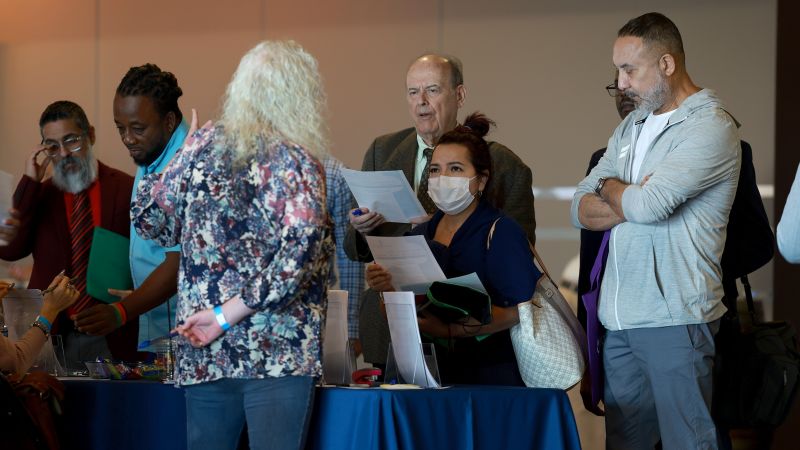

What happened last week? The red-hot labor market is cooling, signaling to investors that the stock market is on the verge of a correction.

High growth, large-cap stocks that have surged recently have caused investors to dump them in favor of defensive stocks.

While tech stocks recovered somewhat by the end of the short trading week — markets were closed in observance of Good Friday — the Nasdaq Composite still slid 1.1%. The broad-based S&P 500 fell 0.1% and the blue-chip Dow Jones Industrial Average gained 0.6%.

Michael Arone: I think that this has been a nice counterbalance to the weaker labor data earlier last week and all the recession fears. The data shows the economy is in good shape and the 10-year Treasury yields went up on Friday, that shows less fear about a recession.

The markets are not sure if the Fed will cut rates this year. But there likely won’t be a notable rally unless the central bank pivots or at least indicates that it plans to soon, said George Cipolloni, portfolio manager at Penn Mutual Asset Management.

What is next? The Fed holds its next meeting in early May. In order to get a sense of the economy’s direction, it will have to read several economic reports. The Fed is expected to raise rates by a quarter point, according to the FedWatch tool.

We’ve seen weakness in the interest rate sensitive parts of the market — areas that are typically the first to weaken as the economy slows down. Things like manufacturing and construction. That is where the weakness in the jobs report is. And the services areas continue to remain strong. That’s where the shortage of qualified skilled workers remains. I think that there is continued job strength in those areas.

The US economy added 2360,000 jobs in March, but the pace of job creation was slower than in previous months. The unemployment rate currently stands at 3.5%.

The First Month of Jobs Data from the U.K. Federal Reserve and the Stability of Wall Street: Expectations for Wall Street and Financial Services

The University of Michigan conducts a consumer sentiment survey. Earnings from JPMorgan Chase (JPM), Wells Fargo (WFC), BlackRock (BLK), Citigroup (C) and PNC Financial Services (PNC).

Stock markets were closed on Friday because the jobs report was released on a holiday.

It was the first monthly payroll report since Silicon Valley Bank and Signature Bank collapsed. Since the Federal Reserve began hiking interest rates, there has been a full year of jobs data.

Wages increased by 0.3% on the month and 4.2% from a year ago. The three-month wage growth has dropped, now at 3.8%. That’s moving closer to what Fed policymakers “believe to be in line with stable wage and inflation expectations,” wrote Joseph Brusuelas, chief economist at RSM in a note.

“That wage data tends to suggest that the risk of a wage price spiral is easing and that will create space in the near term for the Federal Reserve to engage in a strategic pause in its efforts to restore price stability,” he added.

As it relates to the stock market, I would expect the cyclical sectors to do well — your industrials, your materials, your energy companies. If interest rates are rising, that’s going to weigh on growth stocks — technology and communication services sectors, for example. Less recession fears will mean investors won’t be as defensively positioned in classic staples like healthcare and utilities.

Yes, exactly. It’s difficult to make too much out of any singular data point, but I think this report will hopefully lead to broader participation in the stock market. If those recession fears begin to abate somewhat, and investors recognize that recession isn’t imminent, there will be more investment.

It did. I expect inflation to grow at a slower rate. But I do think that the sticky part of inflation continues to be on the wage front. I think it helps alleviate some of the inflation pressures but we will have to wait to see how it flows through into the report next week. The report about the PPI.

I’m not sure why, but from my perspective, the Fed hasn’t taken into consideration the structural changes in the labor force, and they’re still confused by it. The risk here is that they will keep raising rates until they find a better balance between stabilizing prices and avoiding the kind of weakness that they predicted in the labor economy. That is a risk for the economy and markets.

After decades of thriving growth bolstered by low interest rates and easy credit, commercial real estate has hit a wall. Office and retail property values have been falling since the Pandemic hit, due to lowerOccupancy rates and changes in where people work. The Fed’s efforts to fight inflation by raising interest rates have also hurt the credit-dependent industry.

In a worst-case scenario, anxiety about bank lending to commercial real estate could spiral, prompting customers to yank their deposits. Silicon Valley Bank is no longer in business, because of a bank run last month that raised fears of a recession.

“We’re watching it pretty closely,” said Michael Reynolds, vice president of investment strategy at Glenmede, a wealth manager. Some institutions could find themselves caught up in the office loan issue, as he does not expect it to get a problem for all banks.

The signs of strain are increasing. The proportion of commercial office mortgages where borrowers are behind with payments is rising, according to Trepp, which provides data on commercial real estate.

Defaults that are high-profile are making headlines. Earlier this year, a landlord owned by asset manager PIMCO defaulted on nearly $2 billion in debt for seven office buildings in San Francisco, New York City, Boston and Jersey City.

Source: https://www.cnn.com/2023/04/10/investing/premarket-stocks-trading/index.html

What should we expect from Big Tech in 2023? A Comment on the Tech News & Wall Street Economics Times ‘2023’

Tech stocks led market losses in 2022, but seemed to rebound quickly at the start of this year. What should we expect from Big Tech?

“Tech stocks have held up very well so far in 2023 and comfortably outpaced the overall market as we believe the tech sector has become the new ‘safety trade’ in this overall uncertain market,” he wrote in a note on Sunday evening.

Tech companies like Meta, Microsoft, Amazon, and others are cutting costs and giving conservative guidance, which is set up for a green environment, because of the macro environment.