The SEC had an account that was compromised and used to post fake news

The Cryptocurrency Market: Why the Bitcoin Price Spikes Up, And Why the U.S. Securities and Exchange Commission Should be Investigated

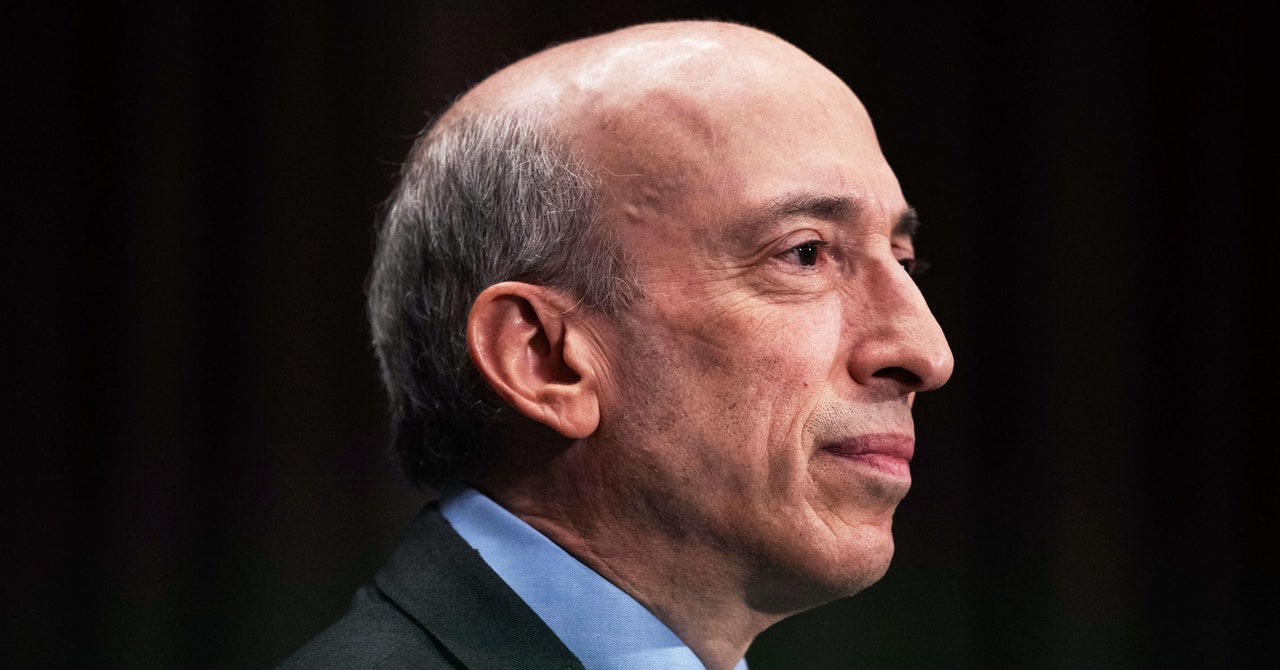

Gary Gensler, the chair of the SEC, said this afternoon that the official account of the United States Securities and Exchange Commission had been compromised. The account, @SECGov, also said the account had been compromised.

This afternoon, the SECgov account published a post regarding regulatory status of the product, which allows people to invest in the virtual currency like standard stocks. The post, which also included an image with an apparently fake quote from Gensler, has since been deleted.

In the minutes after the fake post was published, the price of bitcoin jumped around 2.5 percent, but has since fallen to below 2.5 percent of its original price. In all, the incident led to a $40 billion swing in the combined value of bitcoin in circulation.

In a cosigned letter, Republican senators J. D. Vance and Thom Tillis demanded the SEC answer for the “widespread confusion” and damage to investors it had caused. The incident is contrary to the mission of the commission to protect investors and maintain a fair, orderly and efficient market. Senators Bill Hagerty and Cynthia Lummis, both Republicans, added their voices to the chorus with separate posts on X.

The recent layoffs of X’s staff raised fears that the company was unable to keep up with the demand of its users, which included high-profile figures and government agencies. A former information security official who was fired for alleged wrongful firing sued Musk and others, saying that the staff cuts would make it harder to comply with an FTC consent decree to protect users’ personal information.

A group of US senators want answers from the SEC after a security incident led to fake information being published.

In a statement, the CFTC said it has “enforcement authority” with respect to any alleged manipulation of bitcoin, but declined to confirm whether it would investigate in this instance.

Even though jurisdiction is not an issue, unanswered questions still remain regarding the practicability of an investigation, says Charley Cooper, who was chief operating officer at the CFTC. “The idea of the commodities regulator investigating the securities regulator is unprecedented,” he says. “There is no manual for this.”