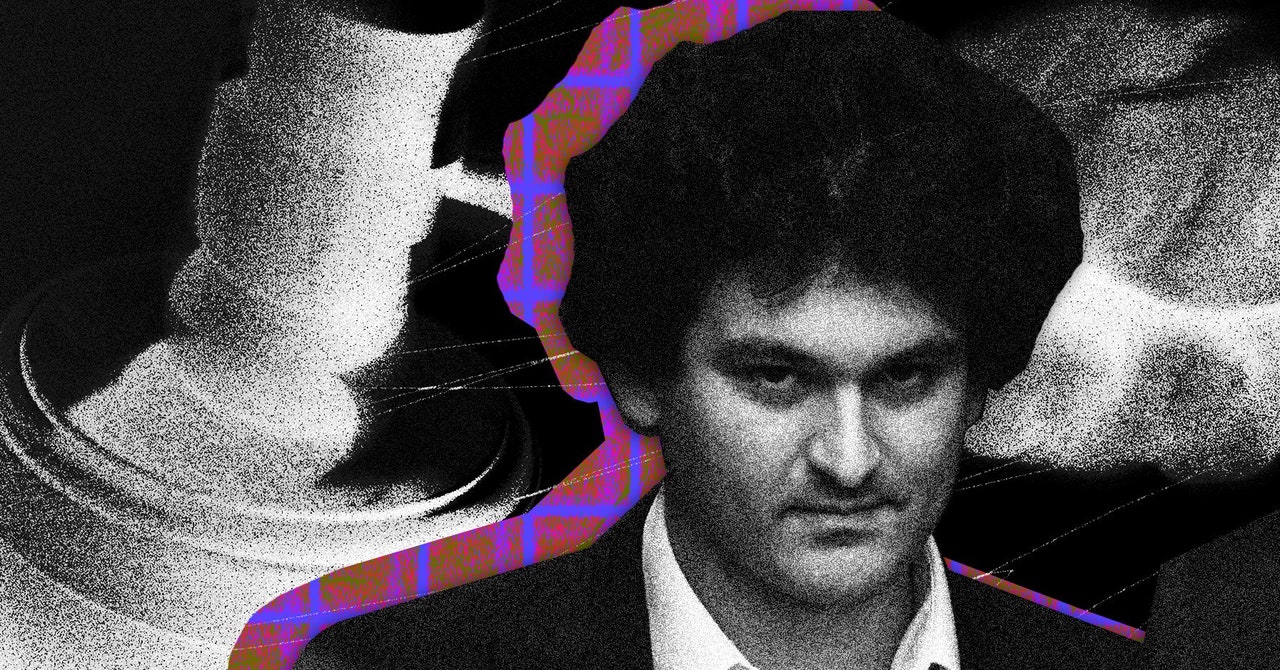

FTX founder Sam Bankman-Fried has been found guilty of fraud

Sam Bankman-Fried, the founding father of the FTX exchange, was born into a Shakespeare hater and mystified by emotion

A jury took only minutes to find Sam Bankman- Fried guilty of seven counts of fraud and conspiracy on Thursday night. As ever, it is perhaps best to start from the very beginning.

As a boy coming of age in the most rarefied quarters of the achievement class, he grew up in a family that viewed the celebration of birthdays and holidays as an inefficiency easily forgone. Michael Lewis writes in his book, “going Infinite”, that he grew up with an adult who worked 22 hours a day and submitted the prospect of any interaction with someone else to a cost-benefit calculation that resulted in him canceling his meetings and deadlines at the last minute.

From the outset, the decision to have Mr. Bankman-Fried testify in the federal trial that charged him with some of the most grievous acts of financial fraud in the country’s history seemed like a self-defeating proposition. Ostentatiously unfazed by physical beauty, art, novels, fashion, religion and heated food, he was also an avowed hater of Shakespeare (“one-dimensional” characters, “illogical plots,” “obvious endings”) who was mystified by emotionally driven decisions, challenging any effort to place him somewhere on a continuum of human relatability.

The US government accusedBankman-Fried of overseeing a multi billion dollar fraud, whereby money belonging to FTX customers was swept into a sibling company, and used to fund high-risk trades, debt repayments, personal loans, political donations and a life of luxury. The exchange went under in November 2022, because it couldn’t meet customer withdrawals.

Estes said that the US Department of Justice would consider Bankman-Fried’s conviction a signature victory. Cryptocurrencies have been used to conceal payments for goods that are not legit, to facilitate cyberattacks and to laundered criminal activity over the last decade. In 2021, the DoJ announced the formation of a specialist crypto enforcement team, to “tackle complex investigations and prosecutions of criminal misuses of cryptocurrency,” it said. The agency had only secured handful of landmark convictions.

The conviction won’t have much effect on the amount of funds recovered in the FTX Chapter 11 process, but it will be celebrated by those whose money was misappropriated. Pat Rabbitte, who used to be a customer of FTX, said he was delighted. The US justice system has done a good job.

The length of deliberation at the end of a trial varies drastically from case to case, taking hours to days. Here, it took the jury fewer than five hours to find Bankman-Fried guilty on all counts. The prosecution had convinced the jury that Bankman-Fried had, per the indictment filed against him last December, architected and overseen a multibillion-dollar fraud.

SEC and the Cryptos: Sam Bankman-Fried, Theranos, Madoff, and Their Legacy (Revisited)

As long as entrepreneurs like Bankman-Fried—and Theranos founder Elizabeth Holmes and Ponzi fraudster Bernie Madoff before him—are able to “buy a fast pass into the kind of esteem in which they were held by some of the most powerful entities in the country,” says Hillmann, there remains cause for concern. The people who were supposed to be watching for warning signs at FTX were, he says, “at best sleeping at the wheel and at worst empowering its activities.” He says there will be another Sam Bankman-Fried.

Other crypto companies seem to think that picking out the one bad apple will be good for the rest of the industry. The outcome of Bankman-Fried’s trial marks a great moment in the history of cryptocurrencies, according to a statement provided to coin desk.

But much of this appears to have been possible because there was so little meaningful oversight of the crypto industry and so much acceptance of companies playing fast and loose. It’s hard to say if the crypto companies left standing are free from all of FTX’s flaws, or how closely they’ve looked over their partners. And then there’s the simple, inconvenient fact that so many of them are under legal scrutiny.

The SEC accused Richard Heart of spending at least $12 million in customer funds to buy sports cars, luxury watches and a black diamond. The SEC also has lawsuits against other firms.