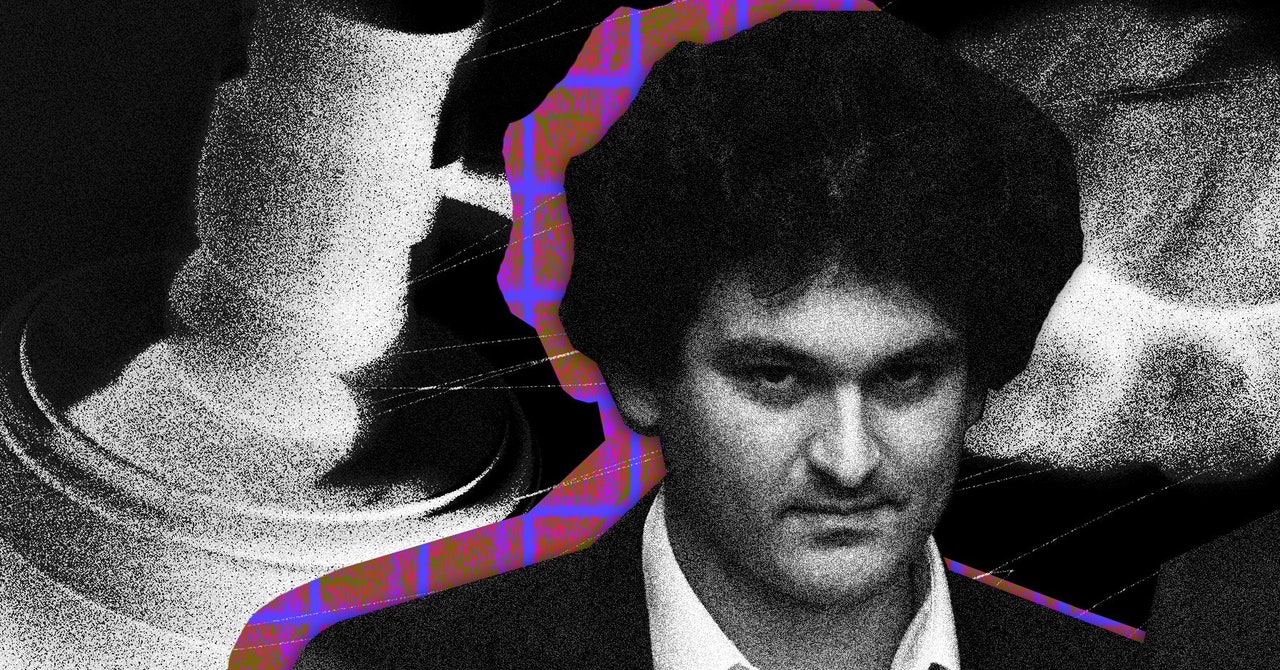

FTX founder Sam Bankman-Fried has been found guilty of fraud

Bankman-Fried vowed never to give up: The emergence of a phenomenological celebrity in the era of high-frequency trading

In court, Bankman-Fried’s defense argued that he had honestly failed at operating a high-risk business. He denied directly supervising the damning code updates that allowed Alameda to spend FTX funds and said he had not participated in trading or questioned employees about billions of missing dollars. He testified that he had no knowledge of Ellison, his former roommates Adam Yedidia and Gary Wang, and his friend Nishad Singh working for Bankman-Fried. Wang, Singh, and Ellison are awaiting sentencing.

His businesses began to fall after the article about the financial health of Alameda. FTX customers were scared by that and pulled their money out of the bank.

Bankman-Fried is likely to appeal the verdict. He is in a federal jail in Brooklyn, facing the possibility of spending his life in prison.

In a courtroom that was frequently packed, prosecutors detailed how Bankman-Fried and some of his top lieutenants secretly funneled billions of dollars in customer assets from FTX to Alameda Research, a private trading firm he also controlled.

The U.S. government said the former billionaire treated Alameda like a personal piggybank, using FTX customer money to buy luxury real estate for friends and family, and to make political donations and risky investments.

“This was a pyramid of deceit built by the defendants to get money, and all of it was lies and false promises,” Asst. U.S. Attorney Nicholas Roos told the court in his closing argument. “And eventually it collapsed, leaving many victims in its wake.”

The conviction marks a reversal of fortune for a young man who just a year ago was living in a $35 million penthouse with his co-workers as he ran a multi-billion dollar digital empire.

As FTX grew, Bankman-Fried became a celebrity in his own right at a time when the popularity of cryptocurrencies surged. Bankman-Fried capitalized on the craze for investments from amateur traders and established Wall Street firms.

Instantly recognizable by his disheveled hair and his typical attire of a T-shirt and shorts, he was feted at conventions, and hung out with celebrities like former quarterback Tom Brady.

Samuel Bankman-Fried – An Executive whose Anomalies Really Drive His Career and Personal Life – a Trial Verdict Against “Ftx” Cryptography

Bankman- Fried’s former executives started to turn against him, including his on-again, off-again girlfriend, and they did it one by one.

She and other colleagues, including Gary Wang – who co-founded Alameda Research and FTX with Bankman-Fried — pleaded guilty to separate charges, and agreed to cooperate with federal prosecutors.

They told the court Bankman-Fried directed them to commit crimes, and their comments were especially compelling because the cooperating witnesses weren’t just Bankman-Fried’s colleagues, they were also some of his closest friends.

Most white-collar criminal defendants don’t give their own defense, so the most dramatic moment in the trial was when Bankman-Fried testified.

Bankman-Fried wilted under withering cross-examination from Danielle Sassoon, a formidable prosecutor who clerked for the late Supreme Court Justice Antonin Scalia.

Bankman- Fried’s comments were used by Sassoon to show a difference between what he said in public and how he acted behind the scenes.

When FTX teetered on the precipice, Bankman-Fried told his hundreds of thousands of followers on X that it was in good shape, even though prosecutors claimed he knew it was not true.

The prosecution’s depiction of Bankman- Fried was at odds with his defense that he was not amovie villain but a math nerd.

The defense also tried to argue Bankman-Fried was an inexperienced executive who was unable to keep tabs on what was happening at two multibillion dollar companies or to properly supervise executives at FTX and Alameda Research.

Signature victory for Michael Bankman-Fried in a federal investigation of a decade of financial fraud in the U.S. Department of Justice

“In the real world, people misjudge things,” Cohen said. “They hesitate. They don’t plan for the unexpected. They make good and bad business decisions, and they make mistakes that later on they wish they could have fixed.”

He was raised in a household that viewed the celebration of birthdays and holidays as an error, even though he was the best in his class. Michael Lewis wrote about an adult who worked 22 hours a day and submitted the possibility of any interaction with another person to a cost-benefit calculation that would leave him canceling meetings and other obligations at the last minute.

From the outset, the decision to have Mr. Bankman-Fried testify in the federal trial that charged him with some of the most grievous acts of financial fraud in the country’s history seemed like a self-defeating proposition. He was unperturbed by physical beauty, art, novels, fashion, religion and heated food and was obsessed with Shakespeare who was bewildered by emotionally driven decisions.

The US Department of Justice will consider Bankman- Fried’s conviction a’signature victory’. It has been used for a decade to conceal payment for illegitimate products, enable extortion and launder the proceeds of criminal activity. The DoJ formed a team to tackle complex investigations and prosecutions of criminal misuses of cryptocurrencies. In the past, the agency had few landmark convictions.