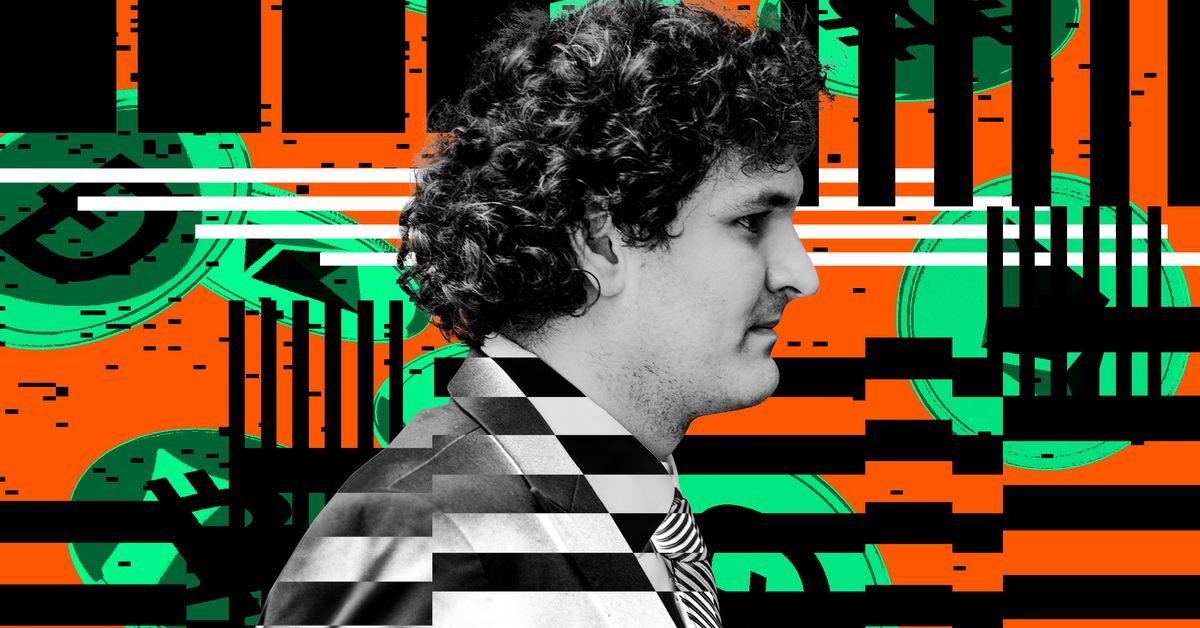

Sam Bankman- Fried is still a gambler

The FTX Thief That Bets: Kaplan and the Judgment of a Criminally convicted Feltthief

Kaplan was unmoved during sentencing. Recapping the trial, he said that Bankman-Fried knew FTX was seriously exposed to risk, that the customer funds weren’t his to use, and that he was well aware that what he was doing was wrong. Bankman-Fried was justified by betting on expected value, weighing the cost of getting caught against the cost of getting away with it.

The jury found him guilty in just four hours. And Kaplan witnessed the whole thing. Bankman-Fried was working against him because of the evasiveness, the weird word salad answers, and the fact that he was asked more questions than he actually was. The judge said he had never seen a performance like that before on the bench.

Kaplan didn’t believe that it was a good use of time to spell out the testimony of Mr. Bankman-Fried. He was evasive, hairsplitting, and trying to get the prosecutor to reword questions in ways that he could answer in a less injurious way than a honest answer would have been. For the last 30 years, I have done this job. I have never seen a performance like that before.

As Bloomberg reports, despite a jump in the value of FTX’s crypto holdings or its stake in the AI company Anthropic, Kaplan said, “A thief who takes his loot to Las Vegas and successfully bets the stolen money is not entitled to a discount on the sentence by using his Las Vegas winnings to pay back all or part of which he stole when he finally gets caught.”

Timing the End of the World: The Life and Death of a Benevolved, Left-Right Black Hole. The Case of John J. Ray III

It all suggested that he wasn’t sorry for what he’d done and his lawyers said he was very sorry for the pain he caused.

Bankman- Fried was placed in the Metropolitan Detention Center because he violated his bail conditions. He gave his co-conspirator and ex-girlfriend’s private memos to The New York Times. Kaplan said Bankman- Fried had engaged in witness tampering at least twice. Bankman- Fried has lost weight because he isn’t getting a vegan diet in jail and he’s been subjected to extortion attempts.

The price of Bitcoin dropped 22 percent on a single day in November of 2022, when FTX was about to collapse. Bitcoin’s now at about $70,000, higher than the peak of the last cycle. I have been told by a suspiciously large number of people that Bankman-Fried is a one-off, just a bad apple. The first two bull runs that I have seen are the third one. I don’t know who the main character is going to be, but I know there will be one.

That is the way he views himself. He’s smart and good. John J. Ray III said in his filing, Mr. Bankman-Fried continues to live a life of delusion.

In order to understand that he’s lost and the jig is up, he has to admit that he is not a good boy and that he is not as smart as he thought. I have sat through endless litanies of his good boy credentials; if we leave aside FTX’s matryoshka doll of crime, he’s better behaved than me. I have been told many times that he is smart. Private school. MIT. Jane Street. You get it.

Bankman-Fried’s arrogance is of a Shakespearean scale. There are a number of forms of arrogance. You don’t need to follow the dress code at an event if you’re so important that you don’t need to wear a suit. The biggest political bribe in history was paid because you wanted to have your way. You must have the greatest charitable impact in the world in order for that to happen.

How Bankman-Fried Did It Work Out? – Judge Kaplan Revisited in a Case of Facing Alameda

The ability to cut your losses is one of the key skills in gambling. The skill is the only thing that matters. Every first-time investor learns that lesson in a bear market. If you try to double-or-nothing your way out of a hole, it might not work out as you plan. It didn’t work out at Alameda or FTX. It was a flop in Bankman-Fried’s trial. It didn’t work out in his sentencing. I suppose we will see about the appeal.

Kaplan lingered on Caroline Ellison’s testimony about Bankman-Fried’s character; specifically, he told her that if there was a coin where tails destroyed the world and heads made the world twice as good, he’d gamble on flipping the coin. If the chances were more than doubled that life and civilization on Earth would come out without that horrible outcome, that was a big part of the case for me.

Kaplan said that the mathematical wizard’s lawyer told him that the wizard was viewing the cost of being caught as discounted by probability and not being caught as a way to escape. That was the end of it. It began as early as Jane Street. The firm Bankman-Fried joined after graduating from college. It is his nature. And you don’t have to take my word for it — everybody has said that.”

I have heard that Bankman-Fried has vaunted intelligence. According to documents filed by the defense, he is misunderstood due to his condition. I saw him perjure himself on the stand. So did Judge Lewis Kaplan, who, in commenting on the perjury, gave three examples: that Bankman-Fried lied about not knowing Alameda spent FTX customer funds, that he first learned of Alameda’s debt in October 2022, and that he did not know that asking Alameda to repay its lenders would necessitate further dipping into customer funds. I do not think lying on the stand is a symptom ofautism.

“I guess there is a big opportunity in the world to do what the world thought I would do, what it hoped I would do, at least for a while, what I hoped I would do for the world, not what I ended up doing,” Bankman-Fried said. “And 300 people that I used to work with, incredibly talented, selfless, impressive people were looking for something to do. If that happens, if they do what they could for the world, then hopefully I’ll be able to see their success, not just my own failures, each night.”

He had to apologize without admitting anything because he was appealing the verdict. I was completely shocked when he began talking about the FTX employees being robbed of their chance to build something great and that they need to come together to create an FTX equivalent.

I believed that Bankman-Fried was sticking to the strategy he had outlined in the document submitted by the prosecution. He was going to blame the bankruptcy lawyers in points 4, 5,6, and 9 on his Google Doc.

At his sentencing, I sat several rows behind Bankman-Fried, clad in prison khaki and clanking faintly when he walked from the shackles on his feet, while he gave his statement to the court. Bankman-Fried apologized about what happened at every stage. “I failed everyone I cared about.”