What does it take to declare a recession?

The Impact of Implications on the Political Landscape of the Economy: A Case Study of Donald Trump’s Pre-election Campaign and the Economics of the Early 2024 Election

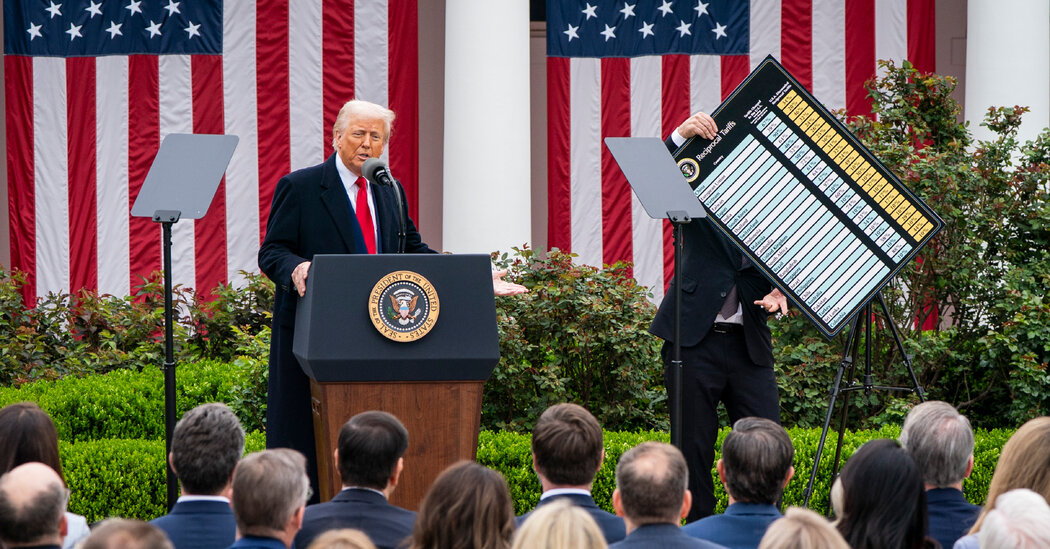

Even before this week’s tariffs, Mr. Trump had squandered his post-election honeymoon. His approval rating has fallen back to where it was before the election. His early threats to raise tariffs, including on partners like Canada, Mexico and Europe, probably played an important role in diminishing his support. The latest polls had found that Mr. Trump’s approval rating on the economy was even worse than his overall approval rating. His actions have taken an early toll on the political landscape, with consumer confidence falling and polls finding that tariffs are unpopular.

Mr. Trump’s political strength is built on the economy, which could be why the Republicans are vulnerable. Throughout his time as a politician, he usually earned his best ratings on his handling of economic issues. He’s benefited from his reputation as a successful businessman and from effective economic stewardship in his first term. He won the last election, despite enormous personal liabilities, in no small part because voters were frustrated by high prices and economic upheaval that followed the end of the pandemic.

More than 40% of voters who supported Mr. Trump in 2024 but didn’t support him in 2020 said the economy or inflation was the most important issue for them to vote on.

Implications of the U.S. Post-WWII Economic Recession in the Light of JP Morgan’s Tax Cuts

A recession is when economic activity declines. It’s one of the four stages of the economic cycle: growth, peak, contraction (or recession) and trough.

The risk of a global recession was raised by JP Morgan in a research report last week.

Its CEO Jamie Dimon doubled down on Monday, writing in his annual letter to investors that the tariffs “will likely increase inflation” and are prompting “many to consider a greater probability of a recession.”

The voices on Wall Street, Capitol Hill, and around the world are starting to call for Trump to delay or reduce the tariffs. Administration officials say that more than 50 countries have contacted them to begin negotiation and that the tariffs won’t be changed.

Treasury Secretary Scott Bessent downplayed concerns about a recession in an interview with NBC’s “Meet the Press” on Sunday. Pointing to March’s better-than-expected jobs report, he said he sees “no reason that we have to price in a recession.”

Since World War II, the average length of a recession has been 11.1 months, according to the business publication Kiplinger. The post-WWII U.S. has averaged a recession every 6.5 years, it adds.

The Business Cycle Dating Committee is made up of top American economists, and they have been declaring the beginning and end of the cycles since 1978.

The longest post-WWII recession was the Great Recession, which spanned 18 months from December 2007 to June 2009 and was triggered when the U.S. housing bubble burst. The brief COVID-19 recession took place in 2020. While the economy experienced two quarters of negative GDP growth in early 2022, fueling fears of a recession, NBER did not declare one.

A growing economy can cause stress to cascade among consumers, companies, and the stock market according to Fidelity.

The severity and rarity of the Depressions is marked by widespread unemployment and pauses in economic activity. NBER does not specifically identify depressions, but says the U.S. is generally regarded to have last experienced one in the 1930s.