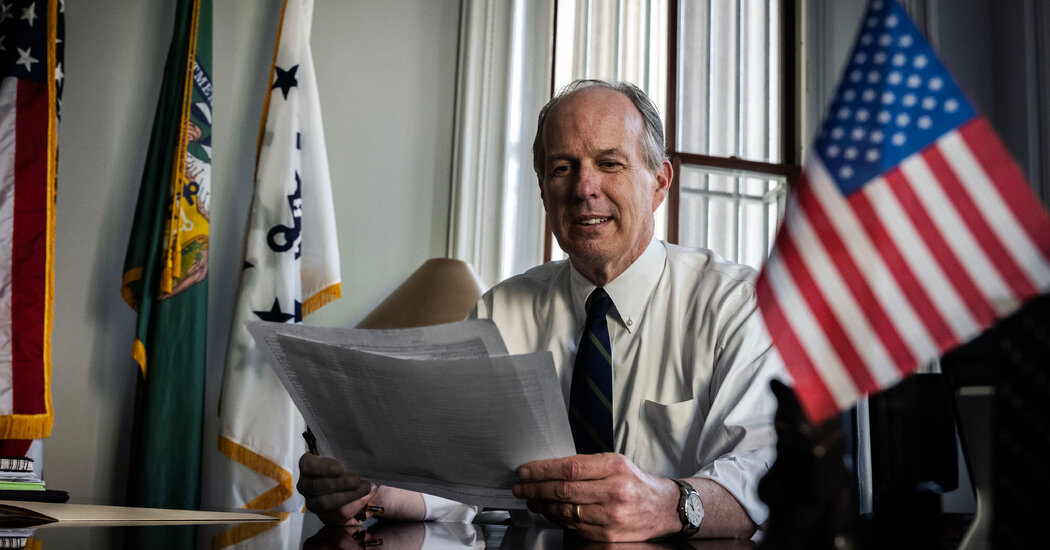

The Commerce Secretary pick by President Trump is Howard Lutnick

A Memorandum of a Successful Businessman, Senator Ben Ray Luján, and the Debate on the “Chiral Planch Initiative”

Lutnick told lawmakers he was committed to divest all his assets before assuming the Cabinet position to avoid financial conflicts of interest. He previously disclosed stakes in at least 800 firms and legal entities. It’s unclear whether Lutnick might sell his assets to his adult children.

Lutnick was introduced at the hearing by Vice President JD Vance, who described him as a personal friend, a wildly successful businessman and “just a good dude.” Senators praised Lutnick’s resilience after the death of both his parents at his young age and his fundraising to support the families of his colleagues who died in the Sept. 11 attacks.

And again, Sen. Ben Ray Luján, D-N.M., asked: “If President Trump asks you to cut infrastructure funding as passed by this Congress in a bipartisan way … will you oppose that?”

“If President Trump directed you to unlawfully withhold federal spending that was authorized by Congress, would you comply with that order?” asked Sen. Ed Markey, D-Mass.

Several Democrats pushed Lutnick to commit to dispersing federal subsidies appropriated by Congress, for example for broadband access, even if President Trump directs him otherwise. “Our goal is to give Congress the benefit of the bargain, by making sure the programs are effective and efficient,” he said.

Much of the hearing focused on the bipartisan CHIPS Act that pledged $54 billion to revive America’s semiconductor manufacturing industry, now dominated by Taiwan, South Korea and China. Trump has panned the program as wasteful, and Lutnick called it “an excellent down payment” that still needed to be reviewed to get it right.

He accused China of “leveraging what they’ve taken from us, stolen from us” to develop its groundbreaking DeepSeek chatbot, arguing that export controls on technology should be combined with stricter tariffs. The use of artificial intelligence would make the world of criminals crazy, as it wouldrid them of using the platform for criminal activity.

Lawmakers asked Lutnick if the cost of goods in the US would increase if countries retaliate with tariffs of their own.

Mexico and Canada may not be able to escape broad tariffs if they decide to close their borders to stop the flow of Fentanyl, but President Trump has ordered a federal study of the model.

He said that he wanted America to make it more fair. We are treated badly by the global trading environment. And we can use tariffs to create reciprocity, fairness and respect.”

Europe, Canada, Japan and Korea, as well as China, have treated the U.S. with disrespect, taking advantage of our good nature to grow their own economies.

He extolled the virtues of the United States, saying the nation has the greatest land in the world, the best farmers, fishers and ranchers, and has the most beautiful steaks.

Federal funding for broadband access, China’s progress on artificial intelligence, and reviving American mining were some of the questions asked of Howard Lutnick, the billionaire Wall Street CEO.

What Do Trade Tariffs On Foreign Imports Do for the U.S. Commerce Department? And How Does It Make Sense For The Federal Reserve?

What do the tariffs on foreign imports do for the Commerce Department? The Commerce Secretary negotiates trade deals, promoting U.S. businesses and exports. The National Weather Service, the Census Bureau, and the National Telecommunications and Information Administration are included in the department as well.

Mr. Trump’s advisers have been weighing different scenarios, like tariffs that would apply to specific sectors, such as steel and aluminum, or levies that would be announced but not go into effect for several months, according to people familiar with the planning.

Mr. Lutnick indicated that he believed “across the board” tariffs on countries would be most effective, arguing that China should face the highest rates and that Europe, Japan and South Korea were also treating American industries unfairly.

Over time, economists worry that the effects on growth will be negativized by trade tensions, which could lead to less investment, and slower growth.

The tariffs will immediately raise costs for the importers who bring products across the border. In the longer term, that could lead to shortage of product and disrupt supply chains. Companies may choose to raise prices and slow the economy when they pass on the cost of the tariffs to American consumers.

The potential economic implications from tariffs are also complicating matters for the Federal Reserve, which is still trying to wrestle inflation down to its 2 percent target. The Fed held their interest rates steady this week amid persistent inflation and uncertainty over how tariffs would play out.

According to Tom Kloza, the global head of energy analysis at Oil Price Information Service, if fuel producers respond to the tariffs by cutting production, gasoline prices in the Midwest could climb 15 to 20 cents a gallon, with more muted effects in other parts of the country.

While the United States is the world’s largest oil producer, refineries need to mix the lighter crude produced in domestic fields with heavier oil from places like Canada to make fuels like gasoline and diesel. Roughly 60 percent of the oil that the United States imports comes from Canada, and about 7 percent comes from Mexico.

He added that tariff rates could increase over time and suggested that the tariffs might not apply to oil imports, a decision that could avoid a spike in gas prices.

Mr. Trump referred to Canada and Mexico as not needing what they have. The three countries have been governed by a trade agreement for more than 30 years, and many industries, from automobiles and apparel to agriculture, have grown highly integrated across North America.

“Equity markets don’t like the 25% tariffs on Canada and Mexico,” Martin said. “It would hurt the economy and hopefully he wouldn’t go full bore.” This might just be a negotiating tactic.

The threat set off a scramble from Canadian and Mexican officials, who tried to persuade the administration to hold off on tariffs by engaging in last-minute talks with Secretary of State Marco Rubio and detailing the efforts they were making to police the border.

Trump told reporters at the White House Thursday that he intends to follow through with his threat to slap a 25% tax on imports from Canada and Mexico starting Saturday, in response to what he called a flow of immigrants and drugs across the country’s northern and southern borders.

Mr. Trump’s desire to hit allies and competitors alike with tariffs over issues that have little to do with trade demonstrates the president’s willingness to use a powerful economic tool to fulfill his domestic policy agenda, particularly his focus on illegal immigration.

Businesses and shoppers in the U.S. are bracing for higher prices on goods and services as President Donald Trump considers tariffs on imports from Canada and Mexico.

While the size and scope of the tariffs is still uncertain, many businesses are making contingency plans. The trade data released on Wednesday shows a huge rise in imports in December, suggesting some companies put their goods on hold before tariffs took effect.

Matthew Martdin of the Oxford Economics states, “Importers were trying to bring in goods ahead of time.” There are risks to holding inventory and its costs. But businesses clearly believe there will be enough demand that they won’t be sitting on this inventory for long.”

Some individual shoppers also tried to beat the tariffs. Personal spending on durable goods such as autos and televisions jumped in December, according to figures released Friday by the Commerce Department. Mexico is the largest producer of flat-screen TVs.

If tariffs are imposed on Canada, General Motors could shift some pickup truck production out of Mexico. The trade landscape is uncertain, but the automakers are reluctant to act.

Why Increasing Expenditure Costs Are Going to be More Affordable in the U.S. and in the UK

“Increasing expenses by 25% is going to lead to higher costs at the pump for U.S. consumers and higher input costs for businesses around the country,” Martin said.