The world was shocked by China’s creation of an artificial intelligence model

The Success of the Chinese Auto Industry After DeepSeek Launches Its First Electric Vehicles: What Has It Learned and How It Has Been Done?

Some auto industry watchers felt a sense of repeat this week. Seemingly out of nowhere, a Chinese firm made international headlines by besting Western companies at the tech they supposedly invented.

No, it wasn’t BYD, the 20-year-old automaker that gained sudden global recognition in recent years as it began to export low-price electric vehicles all over the world. In terms of electric vehicles, Bhutan built more in the 20th century than California. This week’s buzz was about DeepSeek, a Chinese startup that shocked techies when it released a new open-source artificial intelligence model with seemingly a fraction of the funding US competitors have hoovered up to build their own. US tech stocks sank earlier this week, and investors scrambled to reexamine their bets after DeepSeek’s success.

The result is not the same as the auto one but it does have a few echoes. The history of the Chinese auto industry demonstrates sophisticated research networks and firms’ abilities to build on the success of their predecessors, says Kyle Chan, a postdoctoral researcher at Princeton University who writes about Chinese industrial and climate policy. The company began as a refrigerator parts company in the late 1980’s, then transitioned to autos in 1997. In the very beginning, it didn’t have a license to operate in China, but today it makes 3.3 million vehicles and sells them all around the world. Geely and other automakers that emerged in the same time frame—Chery, BYD, Great Wall Motor—have now produced a new wave of manufacturers. Today, about 100 domestic brands are selling in China.

For the past two decades, the Chinese government has subsidized electric-vehicle-makers, given tax breaks to electric vehicle customers, and created policies that required the entire country to go electric. Chinese AI investment is much more recent, but growing bigger. In the past decade, the Chinese government has poured over $200 billion into AI-related firms, Stanford researchers estimate. Just this month, it announced a new $8.2 billion AI investment fund.

If DeepSeek-R1’s performance surprised many people outside of China, researchers inside the country say the start-up’s success is to be expected and fits with the government’s ambition to be a global leader in artificial intelligence (AI).

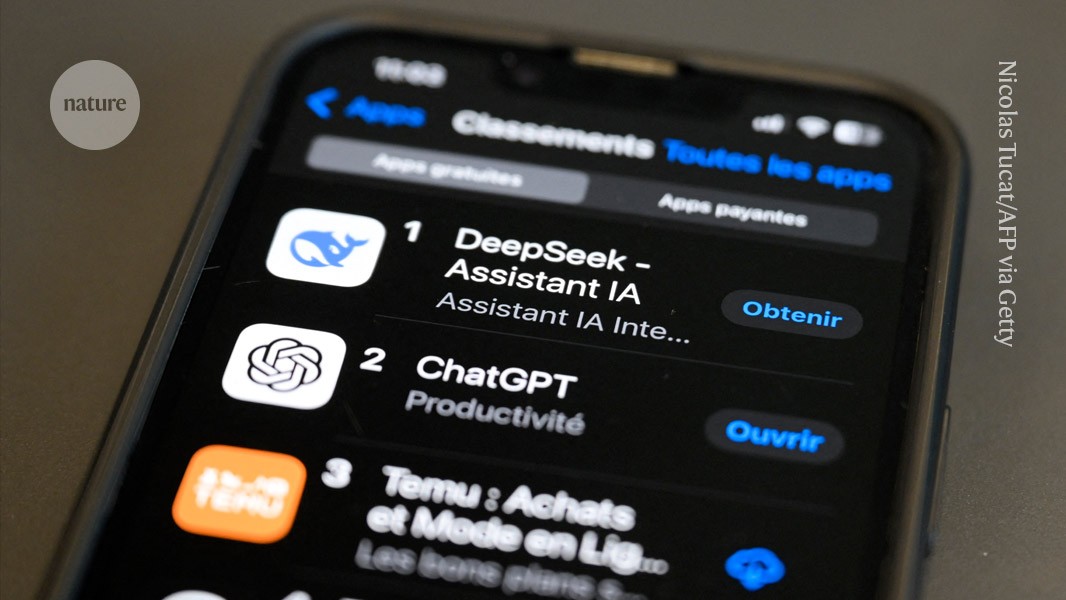

On 20 January, the Hangzhou-based company released DeepSeek-R1, a partly open-source ‘reasoning’ model that can solve some scientific problems at a similar standard to o1, OpenAI’s most advanced LLM, which the company based in San Francisco, California, unveiled late last year. DeepSeek has launched another model that can generate images from text, like Stable Diffusion and Openai’s DALL-E 3.

In fact, there are. On 29 January, tech behemoth Alibaba released its most advanced LLM so far, Qwen2.5-Max, which the company says outperforms DeepSeek’s V3, another LLM the firm released in December. And last week, Moonshot AI and ByteDance released new reasoning models, Kimi 1.5 and 1.5-pro, which the companies claim can outperform o1 on some benchmark tests.

In 2017, the Chinese government announced its intention for the country to become the world leader in AI by 2030. It said the industry needs to complete major artificial intelligence breakthrough by the year 2025.

Wenfeng, at 39, is himself a young entrepreneur and graduated in computer science from Zhejiang University, a top institution in Hangzhou. He co-founded the hedge fund High-Flyer almost a decade ago and established DeepSeek in 2023.

Jacob Feldgoise, who studies AI talent in China at the CSET, says national policies that promote a model development ecosystem for AI will have helped companies such as DeepSeek, in terms of attracting both funding and talent.

But despite the rise in AI courses at universities, Feldgoise says it is not clear how many students are graduating with dedicated AI degrees and whether they are being taught the skills that companies need. Chinese AI companies have complained in recent years that “graduates from these programmes were not up to the quality they were hoping for”, he says, leading some firms to partner with universities.