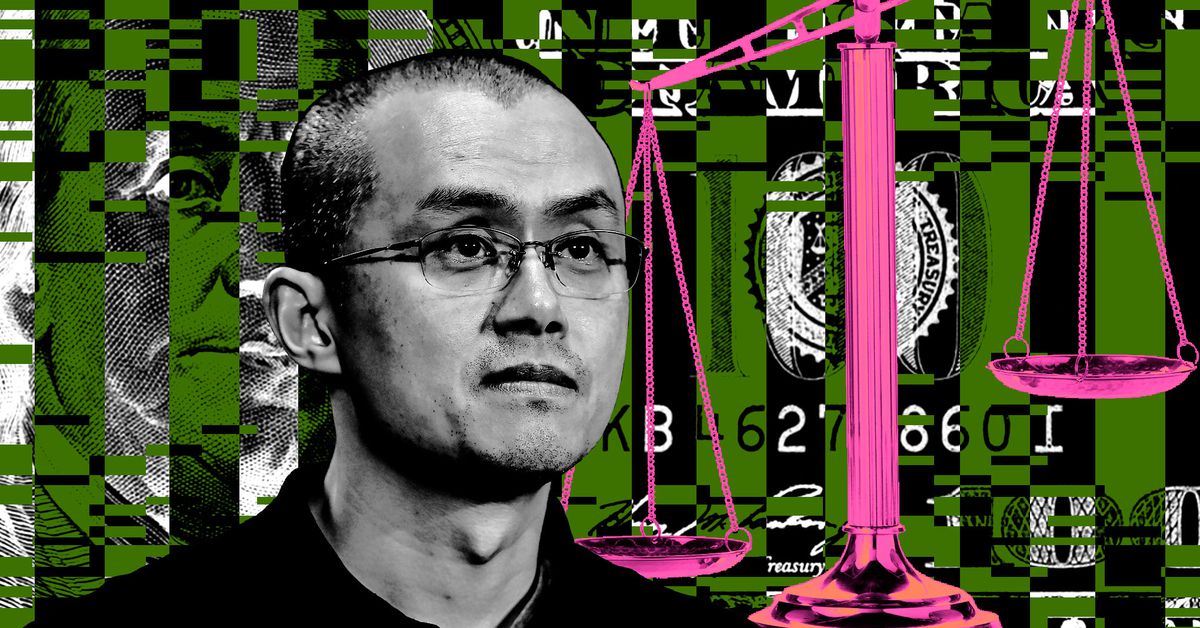

Changpeng Zhao was sentenced to four months in prison

Changpeng Zhao and Sam Bankman-Fried: two different sentences for a crypto figurehead caught on criminal tampering

Sure, there’s no evidence that Zhao knew those groups — as well as hackers, money launderers, and other unsavory characters — were trading on Binance. He just didn’t care who was trading there as long as the business grew. The scale of alleged criminals trading on the world’s biggest platform suggests that Zhao’s information is significant, even if it is not obvious what his nature is.

An independent compliance monitor is inside the company, as a part of the agreement. I assume that means every governmental alphabet soup agency now has eyes on every trade made on the exchange, both in the past and for the next three years, along with identifying information as required by the exciting new anti-money laundering measures at Binance. That kind of surveillance is not nothing for the United States government.

There are a lot of differences between Changpeng Zhao and Sam Bankman-Fried, and now we can add one more to the list: the amount of time they’ll serve for their crimes. Bankman-Fried got 25 years; Zhao got four months.

Zhao is the second crypto figurehead to face criminal sentencing in the US in as many months. On March 28, Sam Bankman-Fried, or SBF, founder of bankrupt crypto exchange FTX, was sentenced to 25 years in prison. They sparred frequently, and vied for control of the exchange market. But the similarities between the cases end there.

The judge was supposed to look past the guidelines in coming to an appropriate sentence, says Daniel Richman, a professor of law at Columbia University and former federal prosecutor. The factors that influence the character of the defendants include their chances of recidivism, past transgressions, and other factors.

Zhao’s guilty plea — to one count with a maximum sentencing guideline of 18 months — was the result of a pretty sweet deal. He had to pay a multimillion-dollar fine and step down as CEO of his company because he didn’t want to be associated with another rich person. I was impressed by the emphasis on the word “cooperation” and references to a sealed matter during his hearing.

“It’s an easy comparison, but an imperfect one,” says Daniel Silva, an attorney at law firm Buchalter and former US prosecutor. “CZ pleaded guilty to not following the law as required of a financial institution executive. SBF was different: He was improperly using customer funds, gained through fraudulent statements and material omissions of fact.”

The distinction was mentioned in the presentence filing by Zhao’s counsel. “Mr. Zhao has been convicted only of an AML [anti-money-laundering] compliance failure,” they wrote. He did not cheat any investors or misappropriate customer funds. They said that their client is not a SBF.

The DOJ, which until last year had secured few landmark crypto convictions, will nonetheless celebrate the conviction. “Whether people criticize the sentence as too light, it sends a healthy message,” says Silva. The goal is to stop the next financial institution CEO from being afraid of anti-money-laundering regulations.

The judge handed down a lighter sentence than the prosecution petitioned, which was three years.

The story of Zhao and Bankman- Fried in the early 1970s. Is there still any information on China left to be grabbed?

There is more to come. When Zhao spoke to his defense, he was dressed in a navy suit with a blue tie. Bankman- Fried was dressed like a prisoner.

I don’t know if it’s Iran or North Korea, though plausibly, there could be useful information on both of those countries. In court, I wondered if there was any information on China left to be grabbed.