The UAW strikes could affect car shoppers

The UAW Stand Up Strike Against Three Detroit Automakers and Two Michigan Auto Factories: Implications for the Economy and the Future of Work

The strike against three Detroit-based automakers by the United Auto Workers is making history but it might not have a big effect on car shoppers.

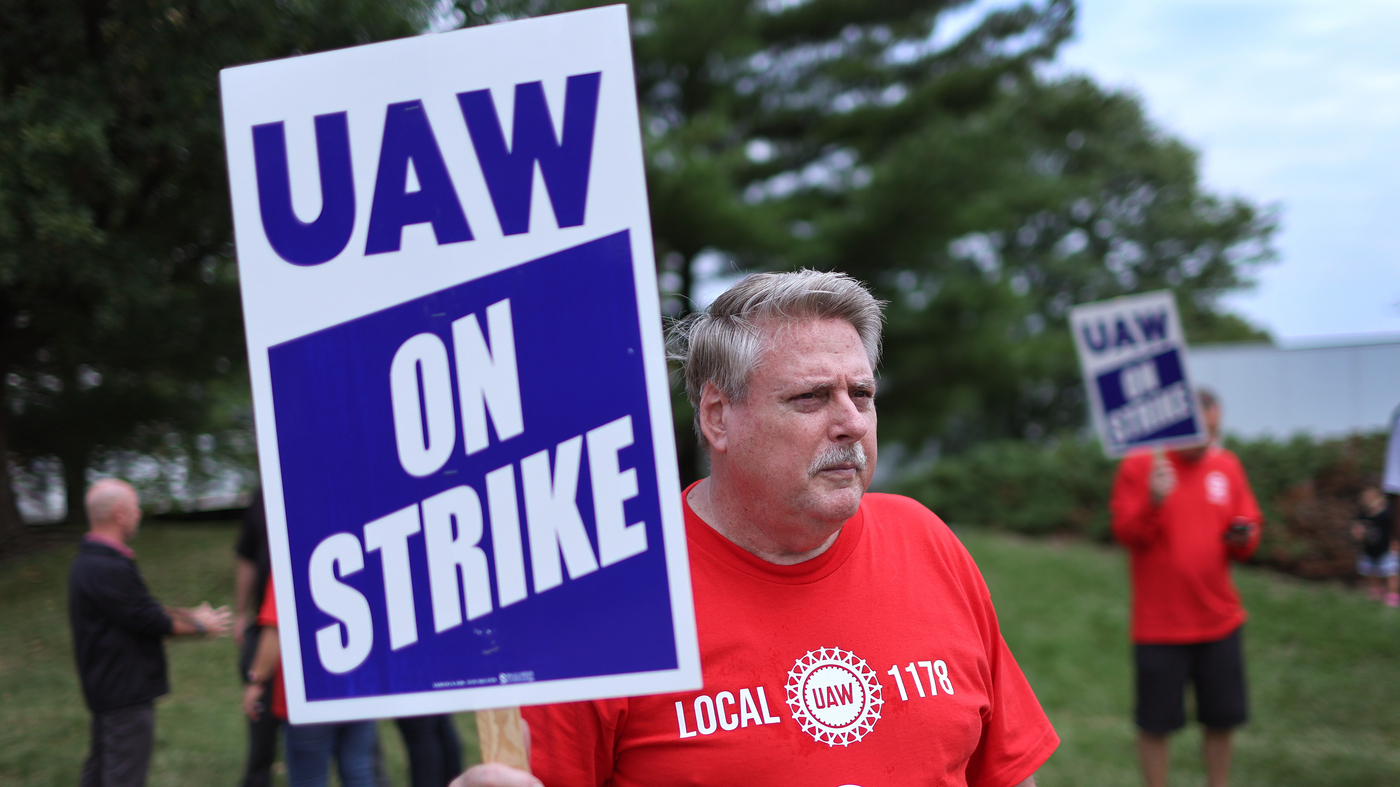

The UAW is poised to announce the plants that will join the group of workers who walked off the job last week.

Many workers are on the picket line at some of the Midwest’s auto plants such as a General Motors plant in Missouri and a Ford plant in Michigan.

“If we don’t make serious progress by noon on Friday, September 22nd, more locals will be called on to stand up and join the strike,” Fain announced in a video posted to Facebook Monday night, while not revealing which plants or how many would be called on next.

The “stand up” strike strategy is intended to keep Ford, General GM and the UAW from having all of the employees walk off the job at the same time.

As a result of the ongoing UAW strike, General Motors temporarily laid off most unionized workers at its Fairfax assembly plant in Kansas. The two other companies have announced layoffs of a smaller scale.

The two sides also remain at odds over other key economic issues, including the restoration of pension and retiree health care and cost of living adjustments. The UAW wants to make up for concessions made to the auto industry in the midst of the financial crisis.

“We haven’t had a raise in years, a real raise,” said Gil Ramsey, a Ford employee who’s on strike in Wayne, Mich. “And everything that we gave up when the company was down on the ropes — we haven’t even got that back yet.”

The front lines of two shifts that promise to make getting around simpler and cleaner but also threaten jobs are being filled by transportation workers. The Biden administration has devoted hundreds of billions of dollars toward greening the nation’s energy system, speeding the shift toward electric cars, trucks, buses, and rail lines. Some of that funding requires employers to pay union wages, but many of the “green jobs” being created pay significantly less and have worse conditions than the fossil-fuel-dependent jobs they’re replacing. Meanwhile, driverless vehicles are beginning to perform paid work previously done by humans. Labor leaders say that if they don’t act now, they risk widespread job loss or degradation, wherein humans become badly paid robot minions.

“When you have an introduction of new technology into a mature industry, there are opportunities where it can be used by employers to undermine strong collective bargaining contracts,” says Greg Regan, president of the Transportation Trades Department, a coalition of 37 transportation unions affiliated with the AFL-CIO, the US’s largest labor federation.

Ford, General Motors, and Stellantis have all launched joint ventures with South Korean electronics companies to make battery components for EVs. The UAW says workers at the plants risk exposure to dangerous chemicals, and that they receive unfairly low pay.

The Teamsters union is likewise worried about job loss from autonomous trucks. Truck driving is the most common job in 29 states, says Peter Finn, a vice president for the union’s western region. “This is going to have a dramatic and potentially disastrous impact on jobs, on communities, and on the economy.” Tuesday’s caravan to Sacramento was aimed at pressuring California governor Gavin Newsom to sign Assembly Bill 316, which would require the presence of a human safety driver in all autonomous vehicles weighing over 10,000 pounds. That would include all the delivery trucks. A poll shows the bill passed the State Assembly and Senate by more than 90 percent of residents and 73 percent of those who didn’t live there, however the office of the mayor has indicated that he might veto it because it could stifle innovation.

These centers are essentially warehouses that ship out parts to dealerships. That means that although these new strikes won’t cause much disruption to vehicle manufacturing, they could relatively quickly start to interfere with vehicle repairs.

Pete is employed at a car dealership. He says this is a major escalation by the UAW, especially from a car owner’s perspective.

It could mean cars that need repairs are stuck at dealerships or body shops “for two months, for three months, when it should be there for two or three weeks, because they can’t get a part,” he says. dealers have been stockpiling parts in order to obtain as many parts as possible but that can only last so long.”

The industry had recent experience with this, he notes. In 2019, the UAW’s 40-day strike against GM disrupted parts shipments, with lingering effects. “It does not come back into place in a single second,” Devivto says. “This takes months to handle the shortages that are about to be created.”

DeVito isn’t sure that that will be enough to prevent disruptions in repairs. Popular vehicles affected would include GM’s Chevrolet, GMC, Buick and Cadillac brands, Stellantis brands Jeep, Chrysler, Ram and Dodge.

The United Automobile Workers’ Union (UAAW) Strike Can Impact Car Prices: How the Big Three Stolen Faint For Sale, Or Does It Still Happen?

The number of cars and trucks that have been built and ready to be sold has increased for the first time in two years.

That’s still not high by historical levels. The Ford Bronco was one of the vehicles which were in short supply to begin with. But overall, America simply isn’t on the brink of a car shortage like it was just a couple of years ago.

“With the current inventory levels in place, we don’t expect a short-lived strike to impact consumer prices in any meaningful way, at least in the near term,” Rebecca Rydzewski, research manager at Cox Automotive, wrote last week.

Although the union surprised the auto industry by striking against all three companies at once, the plan is to gradually ramp up if the company doesn’t make enough concessions.

Instead of completely shutting down the Big 3’s operations, the union has focused on a few assembly plants and warehouses that are used to supply dealers.

Even factoring in the knock-on effects, which resulted in a few thousand temporary layoffs, the vast majority of production facilities are still running.

Decades ago, Ford, GM and Chrysler made up 90% of the domestic auto market. But that’s ancient history today, when Toyota, Honda and Hyundai are also market leaders and the Big Three are just 39% of the market.

Source: How the UAW strikes could impact car shoppers

The UAW Strike Could Prevent the Big Three from plying on incentives to mutate the price impacts on automakers and their rivals

The power of the union has decreased over the years. This strike is not the same as the massive supply disruptions caused by the Pandemic.

Unlike the COVID shock, Cox Automotive Chief Economist Jonathan Smoke notes, the UAW strike “will only impact a portion of the retail business, and the impact will be slow coming.”

The impact on consumers will be the absence of incentives at Big Three auto companies, as they have slowly come back to dealership ads.

Ed Kim, an analyst at AutoPacific, says a strike “could help prevent the Big Three from doing their traditional thing of piling on incentives at the end of the year to move all this metal out.”

Jessica Caldwell, the executive director of insights at the automotive data company, told NPR that they were not sure at this point. It is definitely a risk if it drags on.

Rival companies like Toyota could see this as an opportunity to seize market share, which could mute the price impacts, she notes. Only if they can increase their production to take advantage of their moment.

Cars and trucks of more lucrative models are being offered for much more than their costs by the automakers. The union is aware of that.

Or to put that in economic-ese, “a rise in productivity over the past 20 years provides a buffer against the need to increase vehicle prices,” S&P Global Market Intelligence wrote in a note. A 46% raise for workers, for instance, would increase companies’ costs 2% over 4 years, they calculated.

Over the last four years, car prices rose an astonishing 30% before leveling off at an average of $49,000 for all vehicles and $65,000 for trucks, according to Kelley Blue Book.