The supply chain is already weakened by the auto strike

The EV revolution is on hold as the ‘Big Three’ autoworkers go on strike: The story of the revolving door

Brandon Szcesinka, a 21-year-old union member who works at Ford’s Wayne plant, told Labor Notes that people are angry. “It’s like a revolving door. It’s a job now, it’s not a career anymore. They want us to buy Fords, but how can we pay that much for one?

Tesla operates its Fremont, California, factory with nonunion labor, as the UAW has struggled to find a toehold at the plant. The company has also been accused of violating labor law by the National Labor Relations Board for barring workers from discussing pay and working conditions. Over the years, there have been many OSHA complaints against Musk’s company.

“Lets be clear: this is a potential nightmare situation for GM and Ford as both 313 stalwarts are in the early stages of a massive EV transformation path for the next decade that will define future success,” said Dan Ives of Wedbush. He added that the “clear winner was… Musk and Tesla with champagne now on ice.”

The UAW Goes On! Implications of a Targeted Industrial Strike on the UAW-Expansion for Electric Vehicles

“This is more of a symbolic strike than an actual damaging one,” Sam Fiorani, a production forecaster at AutoForecast Solutions, told Reuters. Not everyone was in agreement.

One consequence of a prolonged strike may be a supply crunch that, much like the one caused by Covid, could push up consumer prices for car and parts. Meanwhile, the wider auto supply chain may face another stress test that could affect hundreds of companies and thousands of workers beyond those who put the finishing touches on cars.

The union notes that the three auto companies have made a combined $21 billion in profits in the first half of this year and the workers want their fair share.

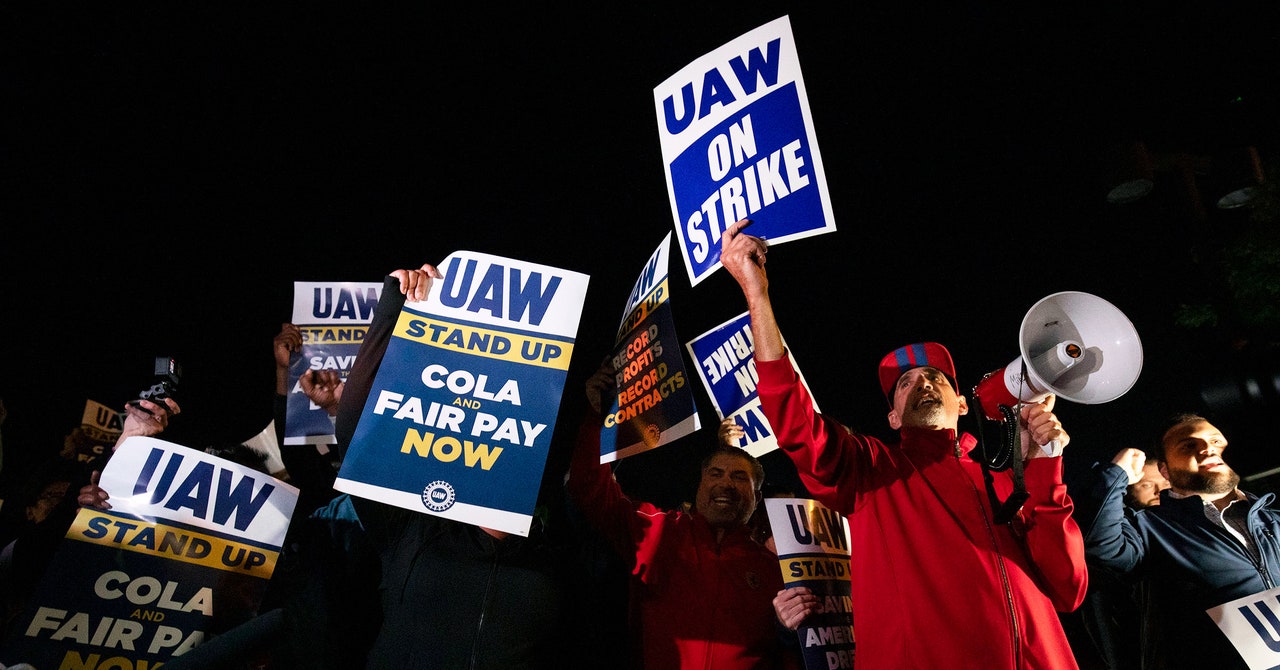

At midnight on Friday, the United Auto Workers (UAW) went on strike, imperiling the “Big Three” automakers’ plans to spend billions of dollars on electric vehicles in a bid to catch up to Tesla.

The plans have been put on hold because of the demands of the workers who want to take to the streets to demand a better share of the profits from SUVs and trucks.

The UAW decided to go ahead with a targeted strike. Workers at three plants — GM’s Wentzville, Missouri, assembly, Stellantis’ Toledo, Ohio, assembly complex, and Ford’s Wayne, Michigan, assembly plant — were the first to go on strike. UAW president Shawn Fain said the union would hold off on a more costly national walkout for now, but it’s still on the table if contract negotiations don’t progress.

Ford said it got a counter proposal from the union hours before the current contract expired, but there was little movement from the previous proposal.

“If implemented, the proposal would more than double Ford’s current UAW-related labor costs, which are already significantly higher than the labor costs of Tesla, Toyota and other foreign-owned automakers in the United States that utilize non-union-represented labor,” Ford said in a statement.

The Big Three, GM, and Automakers: The Covid-19 Pandemic, EV Prices, and the Future of the Automobile Supply Chain

GM CEO Mary Barra noted that the two sides were still far apart on key issues. “We still have a ways to go with the offer they put on the table last night,” Barra said on CBS This Morning on Friday.

The Big Three spend roughly $65 to $68 an hour on total labor costs, with their non union competitors only spending around $55 an hour.

“The big issue for GM and Ford as well as investors is around if anywhere near a ~40% wage increase gets approved/agreed this will be a major headwind on the cost front and ultimately in some way be passed down to the consumer and thru EV prices,” he wrote in a research note. The high cost of EV vehicles out of Detroit leads to mass adoption with the added cost of vehicles, which would result in demand Churn.

When a strike lasts for long, it could force Big Three automakers to agree to major increases in labor costs which could be passed along to the consumer.

Mike Wall, an automotive analyst with S&P Global Mobility, said that suppliers had been through a lot over the last three and a half years. There was the pandemic, sure, but also a related microchip shortage that bit hard because vehicles now require more computing components; a commodity squeeze influenced by war in Ukraine; inflation; and interest rate hikes.

If automakers fail to reach an agreement with the UAW, a nasty domino run will begin inside the auto supply chain over the next few weeks and months. The giants of Detroit will tell their largest suppliers to stop sending them new parts, and these companies will in turn tell their own suppliers to stop sending them components. If the suppliers stop sending the stuff, they may not have access to the cash they will need to hold themselves over.

The Covid-19 Pandemic exposed the public to the world’s wide network of manufacturers, assemblers, and shippers behind every consumer product that is shipped to your door. Or a driveway. Complicated supply chain and worker shortages have led to an explosion in car prices.