Inflation continues to decrease, offering relief to consumers

Inflationary Risks from the Fed: Predictions from a Post-Meeting News Conference in Washington, D.C.

They want to slow the economy and make sure inflation is stamped out, but without hitting the brakes so hard that growth grinds to a stop and workers lose jobs, they are trying to strike a delicate balance.

Fed policymakers could still signal their intent to raise the interest rate later in the year, even if they don’t raise it this week. Federal Reserve chair Jerome Powell could also stress during his post-meeting news conference that rates will remain elevated until inflation is under control.

The Personal Consumption Expenditures index is a measure that Fed officials use to keep inflation at 2 percent. The Consumer Price Index measure comes out a few weeks earlier and contains data that feeds into the Fed’s preferred measure, which is why investors watch it so closely for a signal of where inflation is heading.

The costs for some services are starting to rise slowly or even decline. Rental inflation has been expected to go down and that is now happening. Airfares came down sharply last month, and a range of recreation-related purchases — from movie tickets to pet care — moderated in price.

Recent data shows that the Fed is beginning to control price increases. Fed officials have been raising interest rates in a bid to make borrowing money more expensive in order to slow consumer demand and prevent a strong labor market from causing rapid inflation. With borrowing costs having been lifted for 10 meetings in a row, it has been suggested that officials may soon take a pause and evaluate how the adjustments are working.

“They are probably feeling a little bit relieved,” Laura Rosner-Warburton, a senior economist at MacroPolicy Perspectives, said. The report included both encouraging and discouraging news for policymakers, she said: “It lets them pause, but it keeps them pretty firmly on track” to raise rates again in the future.

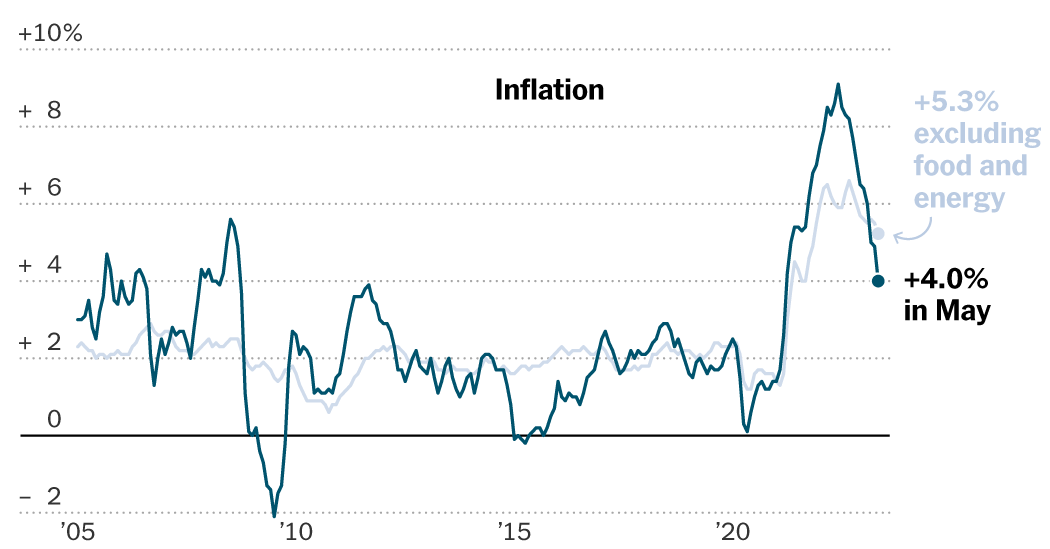

After the onset of the coronaviruses epidemic in 2020, the rate was double normal, but it is down sharply from a peak last summer.

Consumer prices in May were up 4% from a year ago, according to a report from the Labor Department Tuesday. That was the smallest annual increase since March of 2021.

Inflationary Puzzles in the U.S. During the May 4 Meeting: Fed Executives, Energy Prices, and the Consumer Cost of Living

Federal Reserve officials received an encouraging inflation report on Tuesday as a key price index slowed more than expected in May, news that could give policymakers comfort in pausing interest rate increases at their meeting this week.

“I think they have an opportunity here for a hawkish pause or skip or whatever you want to call it,” Patterson said. I believe Powell Chair is going to emphasize how long they’re going to remain at, given the need to get inflation back down.

The falling price of gasoline and eggs took some of the sting out of inflation last month. The cost of living is still climbing fast.

Prices rose 0.1% between April and May, a smaller increase than the month before. Rising rents and used car prices were partially offset by cheaper gasoline and electricity.

The Fed is expected to keep interest rates on hold at this week’s meeting. But additional rate hikes could follow if inflation remains stubbornly high.

The Fed has a lot of work to be done, according to Patterson. Five percent inflation is much better than 9%, but still far from their 2% target.

The challenge for consumers — and the central bank — is that inflation has been a moving target. Just as one source of pocketbook pain is resolved, another pops up to take its place.

Energy prices that spiked after Russia’s invasion of Ukraine have come back to earth. Eggs have fallen in price as flocks of laying hens are coming back from the bird flu outbreak.

“Supply chains have normalized,” says White House economist Ernie Tedeschi. Goods inflation that has trended down seem to be a result of that.

But as Tedeschi and his colleagues acknowledged in a recent blog post, inflation around the price of services “has remained elevated in recent months and is unlikely to be resolved by lessening supply chain frictions alone.”