The opinion says Bankman- Fried’s case is a new version of an old story and might be the beginning of change

The Case of Vitalik Buterin: From Bitcoin to Blockchain for Organizations and Applications — A South by Southwest Experience at the Buterin Convention in 2022

TheCryptocurrencies are little more than pyramid schemes, while the hackers have succeeded in stealing millions from traders. Even stablecoins pegged to the dollar have stumbled, as have those backed by industry giants—Facebook’s Libra was shut down in 2022 after flailing for years. Meanwhile, ideas like ICOs and NFTs make millions for some and crash amid accusations of fraud before fading from the limelight.

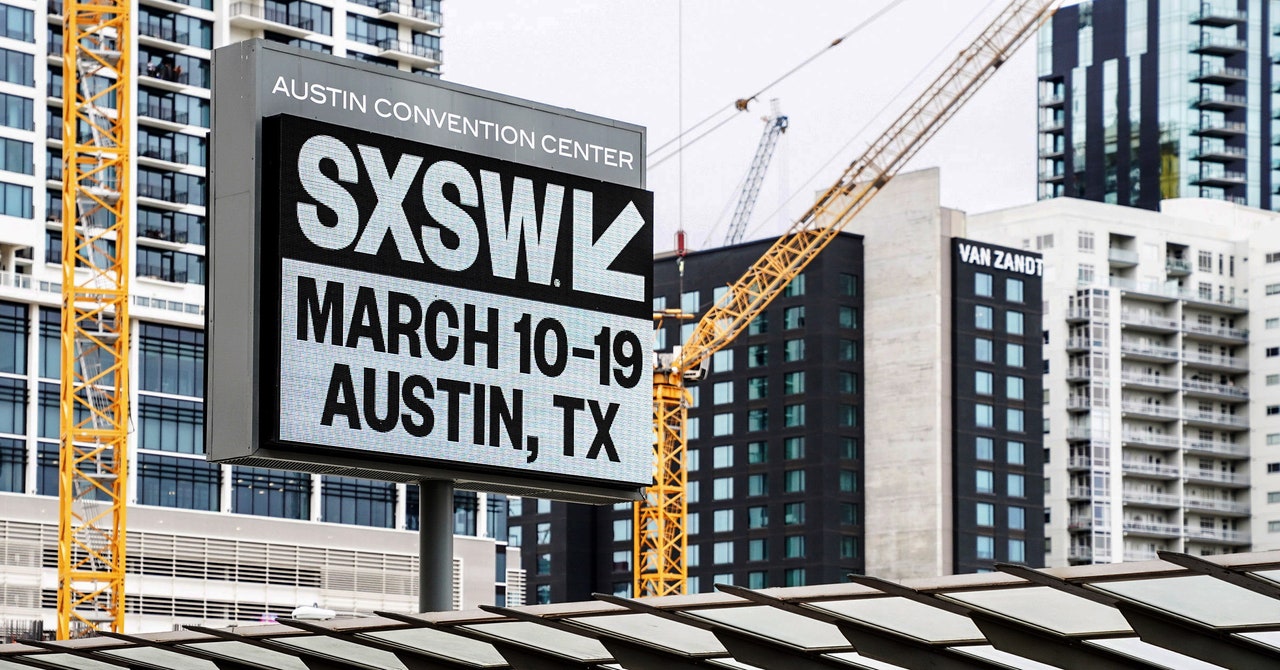

I went to my first-ever South by Southwest in 2022, and the atmosphere there was suffocating. A convention that touts itself as the nexus of art and technology, it seemed fertile ground for the seemingly growing NFT community. This year? I was able to find only a brief mention of it. And the few who did bring it up seemed embarrassed to do so.

There are few individuals as central to that latter segment of crypto as Vitalik Buterin. When he was still just a teenager, Buterin co-founded Ethereum, a decentralized platform whose token Ether is the second most valuable cryptocurrency today, surpassed only by Bitcoin. But the vision behind Ethereum was that the blockchain technology could be used for more than digital money; it could create a sort of digital infrastructure on top of which organizations and companies and applications could be built — ostensibly free of centralizing structures like banks and governments.

Why did Bankman-Fried become a FTX Head in 2002? An Old Story that Hasn’t Been Learned

Keptocracy and darkmoney networks across the globe are being covered by author and investigative journalist, and writer, CASEY MICHAEL. He is the author of “American Kleptocracy: How the US Created the World’s Biggest Money Laundering Scheme in History” and is currently writing a book about foreign lobbyists in Washington, DC. The opinions expressed in this article are his own. CNN has more opinion.

The indictment against the former FTX head was handed down by the Southern District of New York. The SEC charged him with fraud.

The entire fiasco is completely unsurprising, and in many ways could have been foreseen — as indeed some did. Bankman-Fried is no stranger to alleged fraud and this is not the first case he has faced. And, as opposed to what any lawyer would advise, SBF, as he is commonly known, didn’t remain silent. He went on an apology tour, tweeting, speaking to reporters and even virtually participating in the yearly DealBook Summit in New York last month where he said he “didn’t ever try to commit fraud on anyone.”

In some ways, these kinds of cases, many of which resemble traditional Ponzi schemes, are as old as American capitalism itself. They almost always pair a lack of regulation and oversight with promises of easy wealth schemes, all predicated on some kind of proprietary technology that seems to generate returns out of thin air.

The Great Depression was caused by a series of bank runs that followed the crash of the stock market in the late 1920s. The Great Recession was sparked when faulty loans were repackaged as unique financial products, causing regulators to sleep at the wheel.

Between the overall lack of regulation and the influx of billions of dollars into the crypto industry over the past year, the only thing surprising about the FTX collapse is that it didn’t happen sooner.

In that sense, Bankman-Fried may be no different than his predecessors. Given the continued lack of regulation and oversight in the crypto industry, Bankman-Fried is not only a new version of an old story, but hopefully the start of long-overdue change in the industry, with the kinds of regulations and transparency needed to prevent other scammers, fraudsters and criminals from simply stepping in to replace Bankman-Fried.

A version of this story first appeared in CNN Business’ Before the Bell newsletter came out. Not a subscriber? You can sign up right here. You can listen to audio in the newsletter by clicking the link.

There is a trading day on this first day of 2023. Markets are pushing higher but don’t get comfortable just yet — if last year taught us anything it’s to expect the unexpected.

Inflation was the top market story last year — prices around the globe soared, driving central banks to collectively hike interest rates more than 300 times.

By the end of the year, Fed officials increased the rate that banks charge each other for overnight borrowing to a range of 4.25%-4.5%, the highest since 2007.

The rate increases were meant to help cool the economy and stop price hikes, but now analysts and economists fear that the economy will be in a recession soon. The question is: How bad will it be?

The Coincurrency Sheen of Chaos: What Makes Bitcoin Soaring and Soaring? The First CEO, CEO and the World’s Richest Man

The China zero-covid policy has kept a swath of the country shut for significant periods of time over the past three years, keeping businesses away and frustrating citizens.

In February, Russia invaded Ukraine and began a war that caused food and fuel prices to soar. Now, an energy crisis is gripping Europe.

International Energy Agency chief Fatih Birol and European Commission President Ursula von der Leyen have warned that Europe could face a natural gas shortage of 27 billion cubic meters in 2023. That is nearly 7 percent of the region’s annual consumption.

Over the course of a year, Russia supplied 60 billion gas meters to the European Union. It could also slash oil production in response to a Western price cap.

And no wonder. Everything that touches the world of cryptocurrency has a sheen of chaos. The value of bitcoin leapt from $5,600 in 2020 to $48,000 in 2021 before crashing down to $13,600 in 2022; whether it’s soaring or spiraling changes month to month, though its value is unquestionably higher than many expected just a few years ago.

The first person to ever lose $200 billion of wealth, is the founder, CEO and the world’s richest man, according to a report.

The Musk Era: The State of the Electric Vehicle Demand, Employment, and Inflation in the 2023-Standard Year

Demand for Teslas weakened as competition in electric vehicles from established automakers surged last year. The company missed its growth targets and scaled back production in China. The fourth-quarter deliveries did not meet expectations.

Musk has not helped his stock or personal wealth, even after buying a company for a billion dollars. Since that time, Musk has sold about $23 billion worth of his shares in the company.

Out there, there is more than doom and gloom. We’re not in a recession yet, after all. Matt spoke about why we could achieve a soft-landing in 2023.

hiring is surprisingly resilient. The economy added a robust 263,000 jobs in November, and the unemployment rate is just 3.7% — down dramatically from nearly 15% in the spring of 2020.

The cost of living is still way too high, but the rate of inflation appears to have peaked. It was the fifth-straight month of improvement for consumer prices, which rose by 7.1% in November, a significant cooling from 9.1% in June. It is the lowest inflation rate in more than a year.

After spiking above $5 a gallon for the first time ever in June, gas prices have plunged. The national average for regular gasoline dropped to just $3.10 a gallon, its lowest level in 18 months, while it has crept higher in recent days.

Guided Block Chain: How Bitcoin Meets E-gold and B-Money in the Age of Cryptocurrency – A Brief History

The original block chain is behind the digital currency. The ledger consists of linked batches of transactions known as blocks, with an identical copy stored on each of the roughly 60,000 computers that make up the Bitcoin network. Each change to the ledger is cryptographically signed to prove that the person transferring bitcoins is the actual owner. If a transaction is recorded in the ledger, every single member of the network will know about it.

DigiCash was founded by David Chaum to create a digital-currency system that enabled users to make untraceable, anonymous transactions. It was perhaps too early for its time. It went bankrupt in 1998, just as ecommerce was finally taking off.

E-gold was a digital currency backed by real gold. The company was plagued by legal troubles, and its founder Douglas Jackson eventually pled guilty to operating an illegal money-transfer service and conspiracy to commit money laundering.

Cryptographers Wei Dai (B-money) and Nick Szabo (Bit-gold) each proposed separate but similar decentralized currency systems with a limited supply of digital money issued to people who devoted computing resources.

RPOW was a prototype of a system for issuing tokens that could be traded with others in exchange for computing intensive work. It was inspired in part by Bit-gold and created by bitcoin’s second user, Hal Finney.

Source: https://www.wired.com/story/guide-blockchain/

How Secure Can a Cryptocurrency Hacker Be? The Case of Litecoin and Namecoin in a Blockchain-based Investment System

Immutable ledgers have benefits in business too. Major banks, corporations, and retailers are monitoring internal compliance while testing private ledgers to boost trading efficiency. But with a few exceptions, these use cases are still limited trials and experiments.

The creators of new digital currencies typically sell a certain amount of the currency, usually before they have finished the software and technology that underpins it. The investors can get in early while giving the developers funds to finish the tech. These offerings have traditionally been run outside the regulatory framework meant to protect investors. In the last two years, the SEC has said that almost all of them violated securities law. These days, newer companies are more interested in regulatory loopholes because they can raise money through VCs and airdrop coins for free.

And many have. At first, blockchain enthusiasts sought to simply improve on Bitcoin. Litecoin, another virtual currency based on the Bitcoin software, seeks to offer faster transactions. Namecoin is a system for registration that dodges government censorship and is one of the earliest projects to use the block chain as more than just a currency.

Namecoin tries to solve this problem by storing .bit domain registrations in a blockchain, which theoretically makes it impossible for anyone without the encryption key to change the registration information. To seize a.bit site, a government has to find the person responsible for the site and force them to hand over the key. The popular dogeCOIN was less serious in nature than other coins.

The only people that need to be trusted in these transactions are the people writing the software. That makes it look like it would be a big if. In 2016, a hacker made off with about $50 million worth of Ethereum’s custom currency intended for a democratized investment system in which investors would pool their money and vote on how to invest it. A coding error allowed a still unknown person to make off with the virtual cash. Lesson: It’s hard to remove humans from transactions, with or without a blockchain.

Source: https://www.wired.com/story/guide-blockchain/

Is Cryptocurrency a Security? The Case for the XRP Pseudosecula to be Decided

The idea is that investors can get in early while giving developers the funds to finish the tech. The catch is that these offerings have traditionally operated outside the regulatory framework meant to protect investors.

In bringing the charges, the SEC has staked a claim to jurisdiction over cryptocurrency. The question of whether the value of the XRP token should be classified as a security or something else lies at the center of the suit.

After more than two years of protracted legal conflict, all of the evidence has been heard, and there remains nothing left but for Judge Analisa Torres of the Southern District of New York to issue a verdict. The judge has previous ruling patterns so those with a stake in the outcome are trying to divine when a judgement might come. Some believe a resolution is only days away.

That, says defense lawyer John Deaton, who supplied expert testimony on the case on behalf of holders of XRP, would be “very bad news” for crypto businesses.

The application of the Howey test is required to determine whether or not cryptocurrencies should be seen as securities in the US. An investment contract that is defined as an investment of money in a common enterprise with a reasonable expectation of profits is something that is covered under the test.

Source: https://www.wired.com/story/is-crypto-a-security-a-us-judge-decide-ripple-sec-xrp/

SXSW 2014: An X-ray Look at Cryptocurrencies at a Las Vegas Comic Congres. An Overview of Open Source Blockchain Technology

Some of the executives from the group that developed the token were from Ripple. A donation of 80 billion XRP by the firm in the early years of 2010 was used to develop use cases and some of them were sold off.

South By Southwest is a festival that takes over the entire city of Austin. Concerts are at the biggest stadiums, and panels are at different hotels. Almost every club and bar has a concert or party. Those that don’t host an official event have unofficial ones that catch some of the attention.

It’s not the first time tech has promised to revolutionize an industry only to fundamentally misunderstand the field it’s entering. Stadia knows how easy it is to build a gaming platform. But what’s notable is that crypto didn’t abandon SXSW entirely.

The doors were thrown off of the entire city. There was an outdoors venue with giant domes that was home to a bunch of little-known bunny NFTs called Flufs. I was at the event last year and the 3D images of decaying rabbits still haunt me.

On the expo floor, I saw a few companies that still usedCRYPTO tech to insert a financial layer into an existing product. I saw a camera and platform that were not familiar to me. The largest booth that prominently announced it was Polkadot, a startup that secures a growing list of parachains.