Biden’s budget plan would extend Medicare to the 2050s without adding to the deficit

What Should We Do When Social Security is Off the Table? Predictions of President Biden during his State of the Union Address on Social Security and Medicare

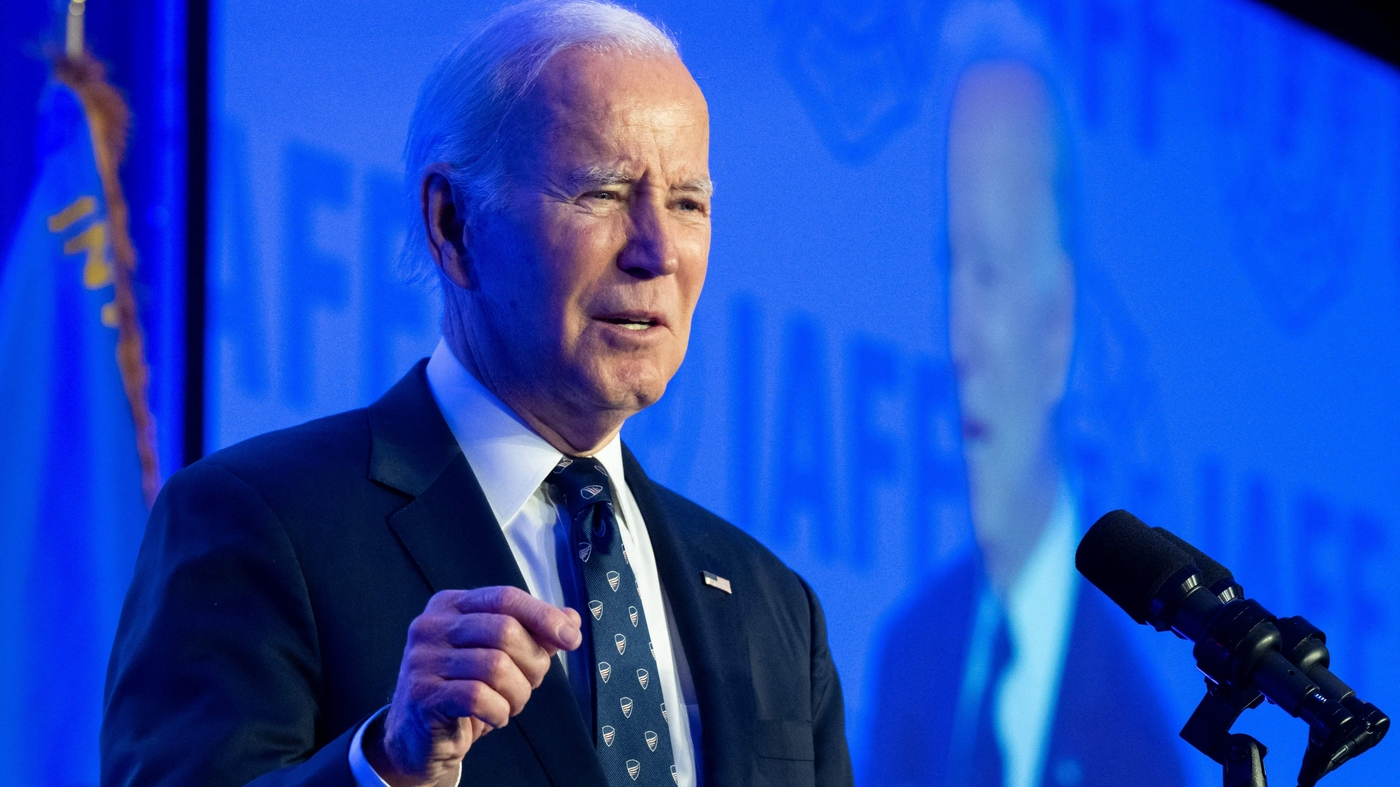

In his State of the Union speech, President Biden promised to prevent the reduction in Social Security and Medicare benefits. He also promised that any tax increases would be limited to families that earn more than $400,000 — roughly the top-earning 2 percent of American families.

Decreases in the elderly and rising health care costs lead to unsustainable figures. The ratio of workers supporting each retiree, which was about 5:1 back in 1960, will fall to just over 2:1 by the next decade. People who live until age 90, a fast-growing group, will spend one-third of their adult life collecting Social Security and Medicare benefits. Today’s typical retiring couple will receive Medicare benefits three times as large as their lifetime contributions to the system, and also will come out ahead on Social Security (adjusted into present value), according to the Urban Institute and the Brookings Institution.

The president’s implication that full benefits can be paid without raising taxes for 98 percent of families has no basis in mathematical reality. Imagine that Congress let the Trump tax cuts expire, applied Social Security taxes to all wages, doubled the top two tax brackets to 70 and 74 percent, hiked investment taxes, imposed Senator Bernie Sanders’ 8 percent wealth tax on assets over $10 billion and 77 percent estate tax on estates valued at more than $1 billion, and raised the corporate tax rate back to 35 percent. America would face among the highest wealth, estate and corporate tax rates in the developed world if there were combined federal income, state and payroll marginal tax rates.

The president’s budget is often ignored by Congress, but this year it has arisen ahead of a deadline to raise the debt ceiling.

Three-quarters of Republicans said they’d prefer to see cuts in programs and services, but Republicans in Congress have been vocal that cuts to programs like Medicare and Social Security are “off the table.”

Biden proposed in an op-ed in the New York Times to invest in Medicare’s trust fund so that the program can stay solvent through the 2050s, and at the same time he proposed to raise the Medicare tax rate for those making over $400,000 a year.

“Lowering drug prices while extending Medicare’s solvency sure makes a lot more sense than cutting benefits,” Biden wrote in the Times, “These are common-sense changes that I’m confident an overwhelming majority of Americans support.”

Biden said Medicare has been a “rock-solid guarantee” for retired Americans and said his proposals were “common-sense changes” that most people would support.